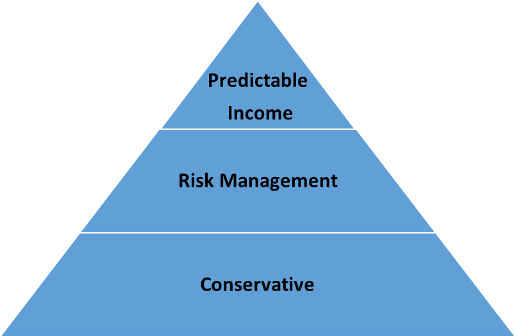

Investment Philosophy

Predictable Income

We are committed to providing constant income through the investment in various bonds, preferred stocks and other common dividend paying stocks. We use the power of monthly compounding to produce increasing income in your portfolio. This strategy helps to increase portfolio value, income for your retirement and minimize volatility in the markets.

Risk Management

Trying to avoid excessive risk is a daily goal to avoid large losses in your portfolio. In volatile markets we use equity hedging strategy uses options in an effort to minimize the impact of market disruptions and downturns. This strategy, known as a hedged equity or options overlay, uses options to dampen volatility and enhance risk-adjusted returns. Equity hedging strategy uses options in an effort to minimize the impact of market disruptions and downturns.

Conservative

In most cases, the return of your money is just as important as the return on your money. Our two most important rules for investing your money are the following:

Rule #1: “Avoid big losses”

Rule #2: “Pay attention to rule #1”

Have you met our team?

We have a wealth of experience in the financial services industry.